The National Hockey League is skating toward another record-breaking financial performance this season, with commissioner Gary Bettman projecting hockey-related revenue to hit approximately $6.6 billion. While early reports suggested figures around $6.8 billion, the official projection represents a solid 5% increase from last season’s $6.3 billion total, demonstrating the league’s continued commercial momentum despite economic headwinds.

This financial upswing carries significant implications for teams, players, and fans alike. The cascading effects will be felt across organization budgets, player contracts, and the overall health of professional hockey in North America. As franchises navigate this prosperous landscape, understanding the key drivers and potential outcomes becomes essential for anyone following the business of the sport.

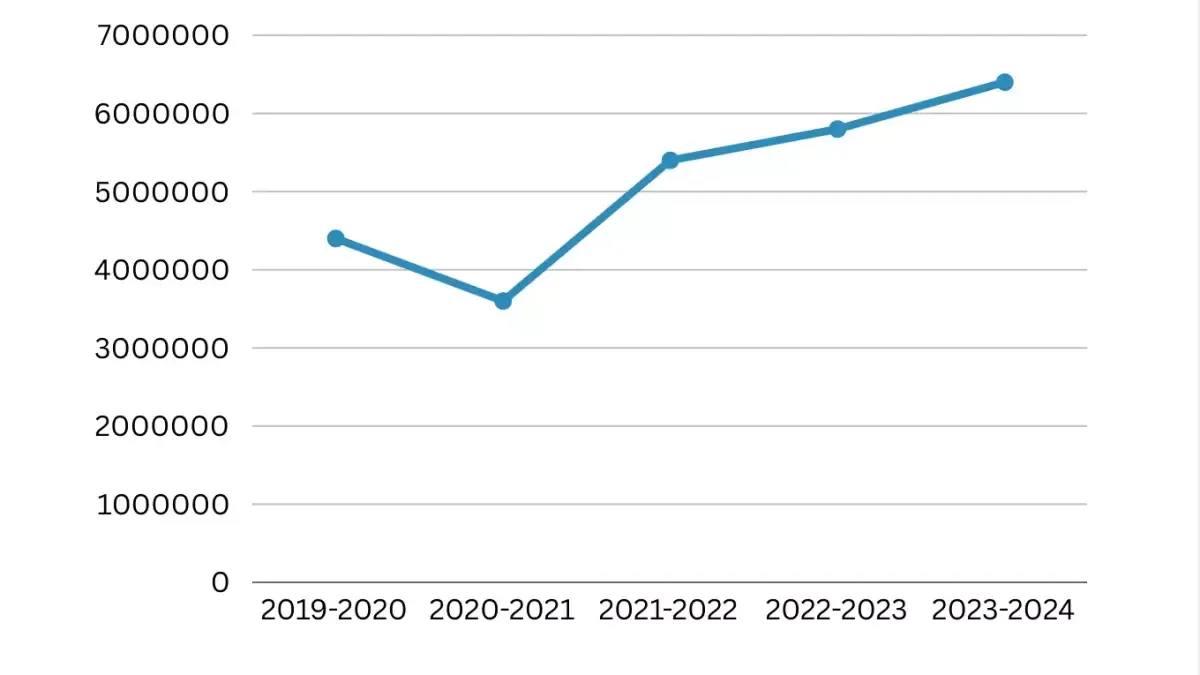

NHL revenue growth trajectory and the 6.6 billion projection

The league’s financial ascent hasn’t happened overnight. After weathering pandemic-related disruptions, the NHL has methodically rebuilt its revenue streams through strategic media partnerships, expanded sponsorship deals, and robust fan engagement. The $6.6 billion projection for 2024-25 reflects this steady recovery and growth pattern.

Bettman delivered this forecast during December’s Board of Governors meeting in Florida, noting that final figures could fluctuate slightly depending on currency exchange rates, particularly the strength of the Canadian dollar. Six of the league’s 32 teams operate in Canada, making the loonie’s performance against the greenback a meaningful variable in the final accounting.

The 5% year-over-year growth rate outpaces inflation and signals underlying strength across multiple revenue categories. This isn’t merely a rebound from pandemic lows but rather an expansion into new commercial territory, with the league capitalizing on its golden opportunity to capture younger demographics through digital platforms and enhanced game presentations.

Key revenue drivers for the 2024-25 season

Several factors contribute to this financial milestone:

- Media rights escalation: The league’s U.S. national broadcast agreement with ESPN and Turner Sports continues to deliver substantial revenue, while regional sports network deals provide steady local income streams

- Gate receipt resurgence: With arenas operating at full capacity again, ticket sales and in-venue spending have returned to pre-pandemic levels and beyond in several markets

- Sponsorship innovation: New categories including sports betting partnerships and cryptocurrency exchanges have opened fresh revenue channels

- Merchandise expansion: The transition to Fanatics as the official on-ice outfitter has reinvigorated licensed apparel sales and created new product opportunities

- International growth: Games played in Europe and enhanced global streaming distribution are tapping into overseas markets

Canadian media rights represent a particularly interesting dynamic this season. Rogers Communications’ exclusive 12-year, $5.2 billion national deal expires after next season, and the company has already entered its exclusive negotiation window for renewal beginning January 1st. The outcome of those discussions will significantly impact future revenue projections.

Salary cap implications and player impact

Revenue growth translates directly into player compensation through the league’s salary cap mechanism. For the 2025-26 season, teams can expect the upper limit to rise to $92.4 million, representing the standard 5% escalator built into the current collective bargaining agreement.

This increase provides general managers with additional flexibility to retain core talent while pursuing free agents. After several seasons of minimal cap growth due to pandemic-related revenue shortfalls and escrow concerns, a consistent upward trajectory benefits the entire player ecosystem.

NHLPA executive director Marty Walsh has been engaged in regular discussions with league officials about potential adjustments to the cap calculation formula. These conversations could result in even larger increases before the current CBA expires in September 2026, though any changes require mutual agreement between owners and players.

The salary floor will rise correspondingly, ensuring smaller-market teams maintain competitive payrolls while receiving revenue sharing support. This balance between large and small markets remains central to the league’s labor peace and on-ice parity.

Collective bargaining context shapes future negotiations

The current CBA, which runs through the 2025-26 season, has provided nearly a decade of labor stability. Formal negotiations on a new agreement are scheduled to begin in February, with both sides expressing optimism about reaching a deal potentially before the 2025 Stanley Cup Final.

Commissioner Bettman has characterized the relationship with the players’ association as “strong and cordial,” crediting the collaborative approach of Walsh and his team. The revenue growth creates a positive backdrop for these talks, as both parties can focus on structural improvements rather than crisis management.

Key issues likely to surface include escrow percentage adjustments, Olympic participation protocols, and potentially extending salary cap rules into the playoffs. The financial health of the league provides room for creative solutions that benefit all stakeholders.

Canadian dollar influence and market dynamics

The projection’s caveat about Canadian dollar strength isn’t mere speculation. When six franchises generate revenue in Canadian dollars but report in U.S. dollars for league-wide purposes, exchange rate fluctuations can swing the final total by tens of millions.

Canadian teams contribute disproportionately to league revenue despite representing less than 20% of franchises. Toronto, Montreal, and Vancouver rank among the NHL’s top revenue generators, while Edmonton, Calgary, and Ottawa maintain solid middle-class financial positions.

The currency wildcard means the $6.6 billion projection could ultimately land closer to $6.8 billion if the Canadian dollar strengthens against its American counterpart in the season’s second half. Conversely, a weakening loonie would hold the final figure closer to the base projection.

Olympic participation and international expansion

Beyond North American revenue, the league is positioning itself for global growth. Deputy commissioner Bill Daly confirmed that negotiations with the International Olympic Committee and International Ice Hockey Federation are “getting close” to finalizing NHL player participation in the 2026 Milan Winter Games.

This breakthrough would mark the first Olympic appearance since 2014, rekindling international interest in the sport’s biggest stars competing for national glory. The league has already committed to a regular rotation of Olympic participation paired with a refreshed World Cup of Hockey tournament series.

These international events function as both revenue generators and marketing engines, introducing the NHL brand to new audiences while creating premium content for broadcast partners. The 4 Nations Face-Off in February 2025 will serve as a tune-up for the Olympic return, featuring United States, Canada, Sweden, and Finland competing in Montreal and Boston.

Looking ahead: sustainable growth beyond this season

The $6.6 billion projection places the NHL firmly in the major leagues financially, though still trailing the NFL ($20+ billion), NBA ($13+ billion), and MLB ($12+ billion). The gap, however, is narrowing through disciplined expansion and strategic innovation.

Several catalysts could push revenues toward $7 billion or beyond in coming seasons:

- New Canadian media rights deal with Rogers or another bidder

- Expanded U.S. streaming partnerships as regional sports networks face disruption

- Franchise expansion to 33 or 34 teams, with rumors circling about markets like Houston, Atlanta, or Salt Lake City

- Reversal of the sports betting prohibition in markets like Ontario, creating new sponsorship inventory

- Continued growth of women’s professional hockey and cross-promotional opportunities

The league’s careful financial management has positioned it to weather economic uncertainty while investing in future growth. With labor peace, international expansion, and digital innovation aligning, the NHL appears poised for sustained prosperity.

Commissioner Bettman’s projection reflects more than just a number—it represents a league that has successfully navigated unprecedented challenges and emerged stronger, more unified, and better positioned to serve its fans and players for years to come. As teams prepare for the stretch run and playoff revenues boost the bottom line, hockey’s business side is performing as impressively as its on-ice product.

Frequently Asked Questions

Par Mike Jonderson

Mike Jonderson is a passionate hockey analyst and expert in advanced NHL statistics. A former college player and mathematics graduate, he combines his understanding of the game with technical expertise to develop innovative predictive models and contribute to the evolution of modern hockey analytics.